Page 34 - Union Budget, 2022

P. 34

Union Budget, 2022

THE INDIRECT TAX FRONT OF THE ECONOMY (GST)

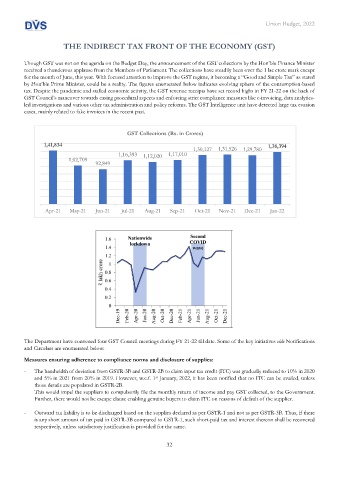

Though GST was not on the agenda on the Budget Day, the announcement of the GST collections by the Hon’ble Finance Minister

received a thunderous applause from the Members of Parliament. The collections have steadily been over the 1 lac crore mark except

for the month of June, this year. With focused attention to improve the GST regime, it becoming a “Good and Simple Tax” as stated

by Hon’ble Prime Minister, could be a reality. The figures enumerated below indicates evolving sphere of the consumption-based

tax. Despite the pandemic and stalled economic activity, the GST revenue receipts have set record highs in FY 21-22 on the back of

GST Council’s maneuver towards easing procedural aspects and enforcing strict compliance measures like e-invoicing, data analytics-

led investigations and various other tax administration and policy reforms. The GST Intelligence unit have detected large tax evasion

cases, mainly related to fake invoices in the recent past.

GST Collections (Rs. in Crores)

1,41,834 1,38,394

1,30,127 1,31,526 1,29,780

1,16,393 1,12,020 1,17,010

1,02,709

92,849

Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sep-21 Oct-21 Nov-21 Dec-21 Jan-22

The Department have convened four GST Council meetings during FY 21-22 till date. Some of the key initiatives vide Notifications

and Circulars are enumerated below:

Measures ensuring adherence to compliance norms and disclosure of supplies:

- The bandwidth of deviation from GSTR-3B and GSTR-2B to claim input tax credit (ITC) was gradually reduced to 10% in 2020

and 5% in 2021 from 20% in 2019. However, w.e.f. 1 January, 2022, it has been notified that no ITC can be availed, unless

st

those details are populated in GSTR-2B.

This would impel the suppliers to compulsorily file the monthly return of income and pay GST collected, to the Government.

Further, there would not be escape clause enabling genuine buyers to claim ITC on reasons of default of the supplier.

- Outward tax liability is to be discharged based on the supplies declared as per GSTR-1 and not as per GSTR-3B. Thus, if there

is any short amount of tax paid in GSTR-3B compared to GSTR-1, such short-paid tax and interest thereon shall be recovered

respectively, unless satisfactory justification is provided for the same.

32